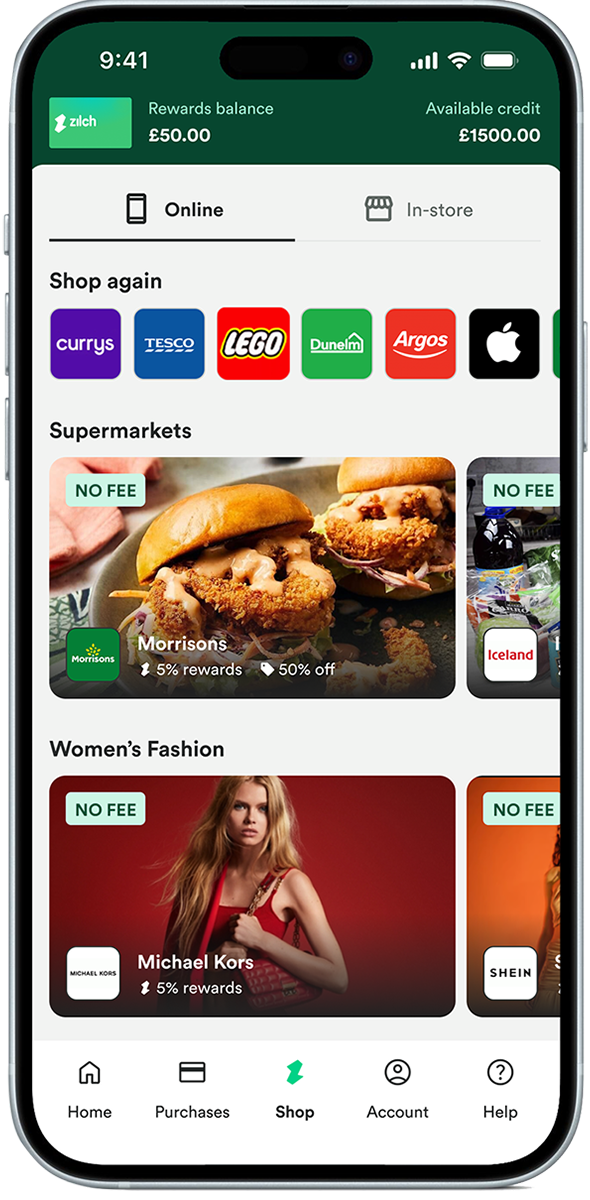

The app’s

where it’s at.

Download the app to get more.

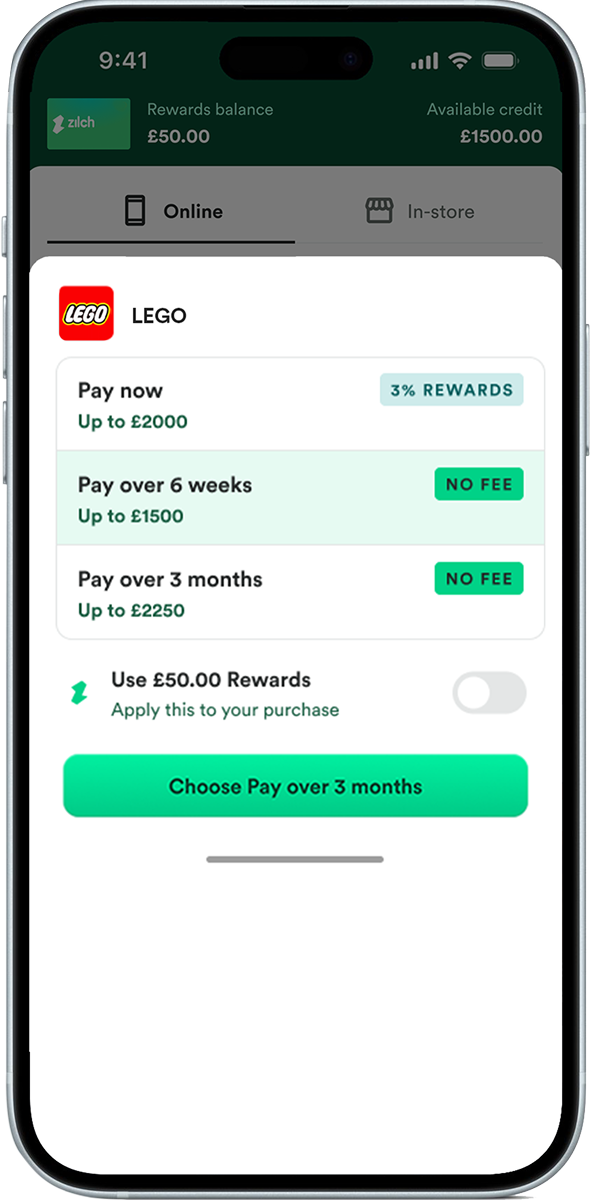

More ways to pay. More

Rewards. More deals. And

credit up to £2250. Let’s go.

From 14.99% APR Rep

Credit subject to status. T&Cs apply

Spend responsibly, spending more than you can afford could seriously affect your financial status. Credit subject to status, 18+, UK residents only. T&Cs apply. Representative Example: 14.99% APR Rep based on a total spend: £1,000 (+£11.50 fees). Total repayable: £1,011.50 paid over 6 weeks or 3 months, 1st payment £11.50, then 2 payments of £333.33 and a final payment of £333.34.

Getting started.

-

1

Download the Zilch app

-

2

Create an account

-

3

See your credit limit

-

4

Link your debit card

-

5

Verify your identity

You could be in within minutes.

Here’s how

it works.

How paying with

Zilch works.

Pay 25% upfront and the rest

over six weeks. Fees may apply.

Today

25% paid

In 2 weeks

25% due

In 4 weeks

25% due

In 6 weeks

25% due

No fees.

Big deals.

Exclusive deals, up to 5% back in Rewards and no fees* when you pay over time at loads of stores. Get it all on the app. *Fees may apply at other retailers.

Shop anywhere.

Really. Anywhere.

Can’t find a store in the app? Just hit the Anywhere button to shop literally anywhere, online or in-store. Fees may apply.

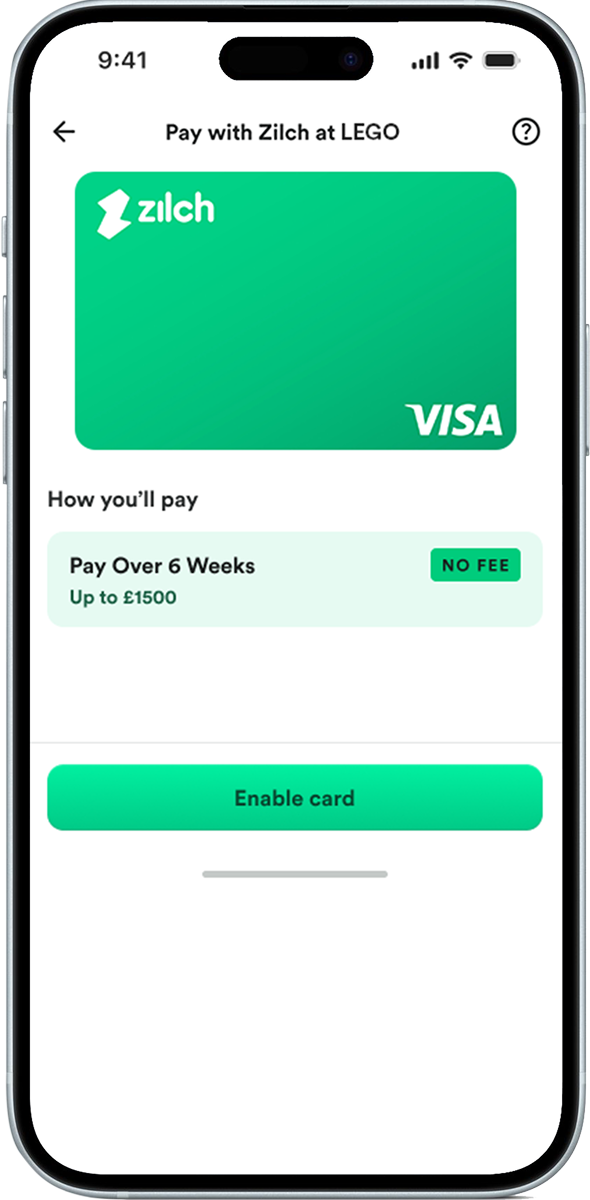

Tap and Pay

on the go.

Add your Zilch card to your digital wallet to Tap and Pay when you’re out and about. Fees may apply.