LONDON, April 07, 2022–(BUSINESS WIRE)–Zilch, the London, head-quartered fintech Unicorn, today announces it has taken another major step forward in innovating its technology to measure affordability through its latest partnership with Experian, the global information services company to begin reciprocal reporting of Buy Now Pay Later credit information.

Zilch continues to pioneer the space by making use of a unique blend of CRA data, Open Banking data and its own proprietary behavioural data to make active consumer lending decisions. This creates a 360 degree view of a customer’s affordability at any given time.

Zilch’s latest partnership with Experian will add reciprocal reporting of payment plans to the CRA’s data set and further demonstrates how Zilch continues to lead the way in responsible lending, ensuring that its customers’ financial health is at the very heart of everything the business does. This follows Zilch being one of the first BNPL companies to secure a Consumer Credit Licence with the FCA in November 2020.

Further, Zilch continues to work hand in hand with numerous partners to create increasing transparency around customer affordability. This means Zilch, as well as other BNPLs, will be able to assess customer affordability more accurately and reward customers for their responsible behaviour.

Through this new partnership, Zilch will connect the comprehensive database of insights into what its 2 million customers can afford, which in turn will assist its active decision-making processes. Zilch uniquely makes use of open banking data and its own proprietary data to assess customer affordability on each transaction and adding this to that mix will only strengthen Zilch and Experian’s ability to drive customer value responsibly.

Philip Belamant, Zilch Co-Founder & CEO, said: “Our mission at Zilch is to provide people with the most ubiquitous and rewarding way to pay for anything, anywhere. This partnership is one of many technology alignments that we are leveraging as we scale in order to create the most comprehensive view of a customer’s affordability all while ensuring performance is fed back to partners allowing others in the space to make responsible decisions too.

Zilch was built with financial health at its core, which is why we were one of the first BNPL to work with the FCA to secure a consumer credit licence. Today, by partnering with Experian, we are continuing to transform the way affordability is assessed which is the key to us delivering financial inclusion to all.”

Paul Speirs, Managing Director of Digital Consumer Information at Experian, said: “By using Experian’s affordability technology, Zilch is able to access a much richer and deeper level of insight into someone’s financial situation, enabling them to provide a better and more informed lending decision. This is absolutely vital given the backdrop of rising inflation and the strain of rising living costs. We’re excited to partner with Zilch to support responsible lending in the BNPL market.”

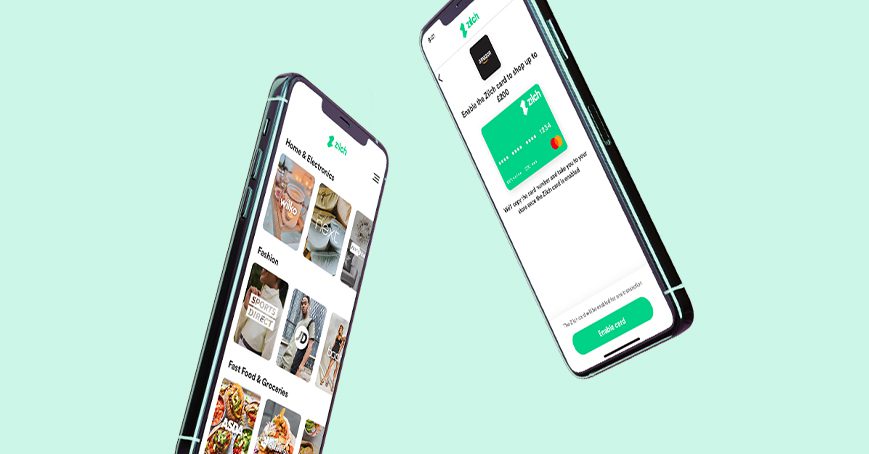

Zilch allows its customers to pay on debit or credit anywhere. Cashback, discounts and short, fixed term, manageable levels of interest-free credit can be used anywhere, anytime, with complete visibility and direct communication of live spending via their Zilch app. To do this, Zilch’s in-house technology uses a per-transaction affordability assessment that’s always proportionately programmed to each customer and unlike credit cards, is updated with each spend. Zilch offers its customers the best ways to pay – credit or debit – save money and get cash back – plan repayments with reminders and/or even deferred instalments (snooze their payment) at no cost.

For more information, visit: https://www.zilch.com/uk/

ABOUT ZILCH

Founded in 2018 and launched in September 2020, Zilch is Europe’s fastest-ever company to go from launch to double unicorn status in just 14 months. Zilch is on a mission to revolutionise the credit payment industry, BNPL (buy now, pay later) 2.0 with innovative products for customers to manage their cash flow responsibly. As one of the UK’s first BNPL providers to be granted a consumer credit licence by the FCA, Zilch’s transparent and customer-centric credit alternative was designed with regulators to ensure consumer protection and financial health from the start. Utilising sophisticated Open Banking Technology and soft credit checks, Zilch uses its real-time view and understanding of consumers’ affordability to give accurate recommendations of what they can afford to borrow. The company is growing at lightning speed with more than 250,000 new customers registering per month, making it one of the fastest-growing payment providers in the world.

Zilch’s merchant agnostic proposition offers its users unrestricted access to the entire retail space, so they can shop wherever they choose. Wanna buy it? Zilch it!

About Experian

Experian is the world’s leading global information services company. During life’s big moments – from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers – we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organisations to prevent identity fraud and crime.

We have 20,000 people operating across 44 countries and every day we’re investing in new technologies, talented people, and innovation to help all our clients maximise every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220406006039/en/

Contacts

For any media enquiries please contact [email protected]

Ryan Mendy, Chief Communications Officer, Zilch

Follow us: https://www.instagram.com/payzilch/

For more information, visit: https://www.zilch.com/uk/